Brought to you by WBIW News and Network Indiana

Last updated on Wednesday, August 1, 2018

(UNDATED) - With college students preparing for the fall semester and 10.7 percent of all student loans 90 plus days delinquent or in default, the personal-finance website WalletHub today released its report on 2018’s States with the Most and Least Student Debt.

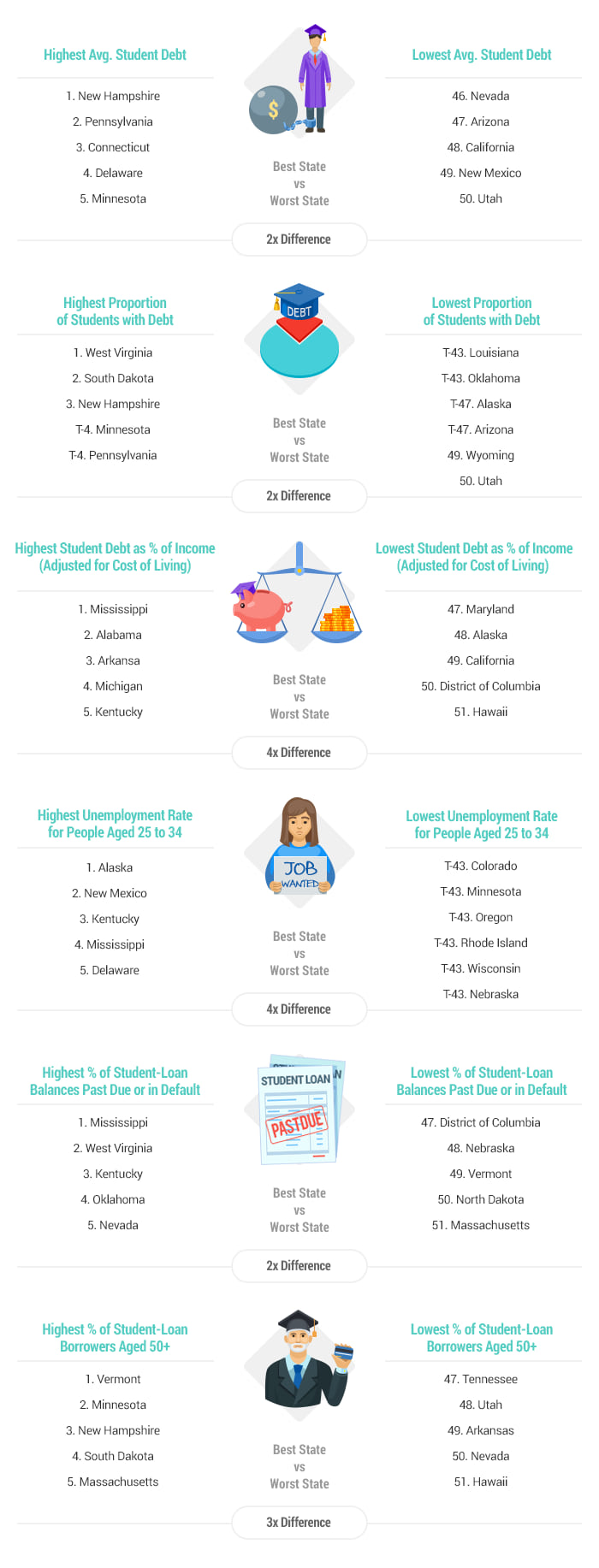

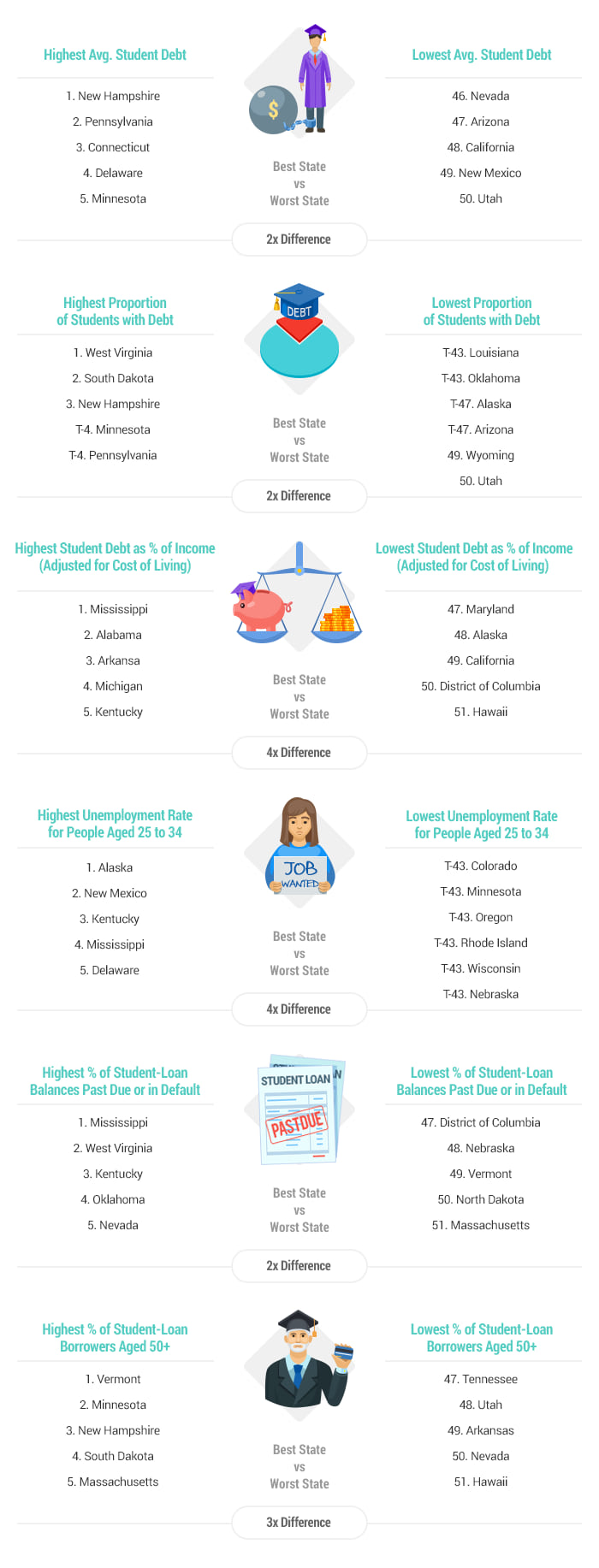

To determine the states that are friendliest toward student-loan debtors, WalletHub compared the 50 states and the District of Columbia across 11 key metrics. The data set ranges from average student debt to unemployment rate among the population aged 25 to 34 to share of students with past-due loan balances.

Student Debt in Indiana (1=Most; 25=Avg.)

Save for mortgages, student loans make up the largest component of household debt for Americans. And our collective debt keeps growing. At the end of the first quarter of 2018, total outstanding college-loan balances disclosed on credit reports stood at $1.41 trillion, according to the Federal Reserve Bank of New York.

There is evidence that income potential rises and chances of joblessness decline with more schooling. But many graduates entering the labor market are learning the hard way that a college degree can't guarantee financial security. Post-college success depends on numerous factors, including where a graduate lays down roots. Student-loan borrowers generally fare better in strong-economy states with low college-debt-to-income ratios.

With student-loan debtors in mind, WalletHub compared the 50 states and the District of Columbia based on 11 key measures of indebtedness and earning opportunities. Our data set ranges from average student debt to unemployment rate among the population aged 25 to 34 to share of students with past-due loan balances. Read on for our findings, insight from a panel of researchers and a full description of our methodology.

Tip: If you're considering borrowing money for college or are in danger of defaulting, we advise leveraging a Student Loan Calculator to determine an affordable monthly payment and payoff timeline.

For the full report, visit: https://wallethub.com/edu/best-and-worst-states-for-student-debt/7520/

1340 AM WBIW welcomes comments and suggestions by calling 812.277.1340 during normal business hours or by email at comments@wbiw.com

© Ad-Venture Media, Inc. All Rights Reserved.