(UNDATED) – The Indiana Department of Revenue’s (DOR) is reminding business owners who are using INtax to pay sales and withholding tax obligations they need to migrate their account to the new e-services portal called INTIME.

The deadline to file and pay the tax year 2020 sales and withholding tax obligations has passed. INtax will no longer provide this functionality. To continue to file and pay, you must migrate your business tax account(s) from INtax to INTIME immediately.

Here is how –

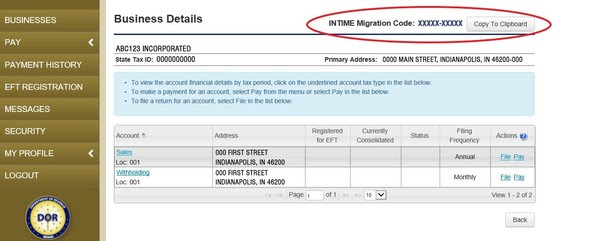

Step 1: Log in to INtax at INtax.in.gov/login to find your migration code. Go to “Business Details” and make note of the INTIME migration code in the top right corner. This code is unique to your INtax account and should not be shared with others.

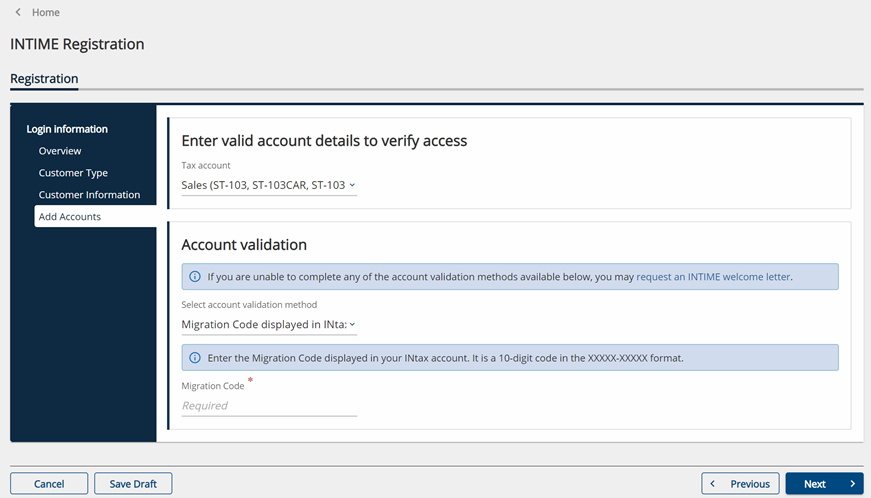

Step 2: Click the INTIME migration code or go to INTIME.dor.in.gov and select “Don’t have a username? Create one” and use the migration code displayed in INtax to validate the account. Continue to follow the instructions on your screen to create your username and password.

NOTE: If you manage multiple businesses in INtax, create a separate login for each business in INTIME.

Business customers may access the following resources to transition from INtax to INTIME at this link. To view, the INTIME Migration Guide click here.

Once you have completed the migration process, additional help is available, if needed. Questions may be submitted directly to DOR Customer Service using INTIME by clicking on the “All Actions” tab followed by the “Messages” section.