NOBLESVILLE – Noblesville police arrested the owner of a massage parlor following multiple citizen complaints and cover investigations into alleged unsolicited genital fondling.

Noblesville police were first tipped off in August of 2020, when an employee with the Noblesville Fire Department came forward with an experience he alleged happened at the Lucky Foot Spa on Cumberland Road in Noblesville.

The man claimed he paid $60 for a one-hour full-body massage. As part of the service, he told police he was led into a room and told to take off his underwear when undressing for the massage. He alleged the masseuse, who he described as an “Asian female” in her 40s, massaged his back then asked him to flip over and “almost immediately” grabbed his genitals and “started on it.” The man told the police he told the woman to stop, and she apologized and left the room.

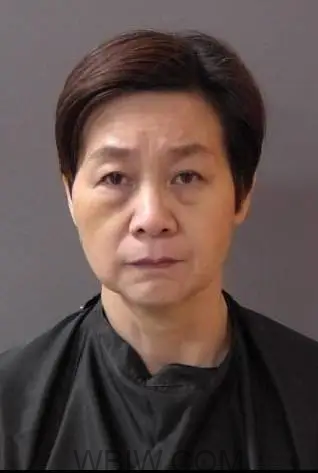

Police began surveillance on the business and reported seeing the registered owner of the parlor, Xiaomei Zhao, 55, regularly come and go.

A second woman identified as “Wendy”, described as an Asian female in her 40s, was also seen inside the business but never entering or exiting the building.

Police said over the following year, they received “numerous” complaints from citizens about unsolicited fondling of their genitals at the Lucky Foot Spa.

A covert operation by Noblesville police and Indiana State Police reportedly netted two incidents in October and November 2021 where Wendy began to fondle undercover officers and negotiate a payment.

After the prostitution investigation began, the Indiana Department of Revenue started looking into possible financial crimes at Zhao’s business. In March of 2022, search warrants were executed at Lucky Foot Spa and three other massage parlors. Investigators took bank records, tax records, and other financial documents.

Tax investigators said Zhao failed to register for a retail merchant certificate, which is needed when a retailer temporarily rents a room used for “adult relaxation, massage, modeling, dancing or other entertainment to another person.” According to court documents, she also failed to collect a sales tax for room rentals.

A tax auditor with the Indiana Department of Revenue obtained Zhao’s business records from November 2019 to February of 2022. Based on her calculations, Zhao should have collected more than $19,000 in sales tax during that time period.

Zhao was arrested on one count of prostitution, one count of promoting prostitution, four counts of failure to remit taxes, and four counts of theft.