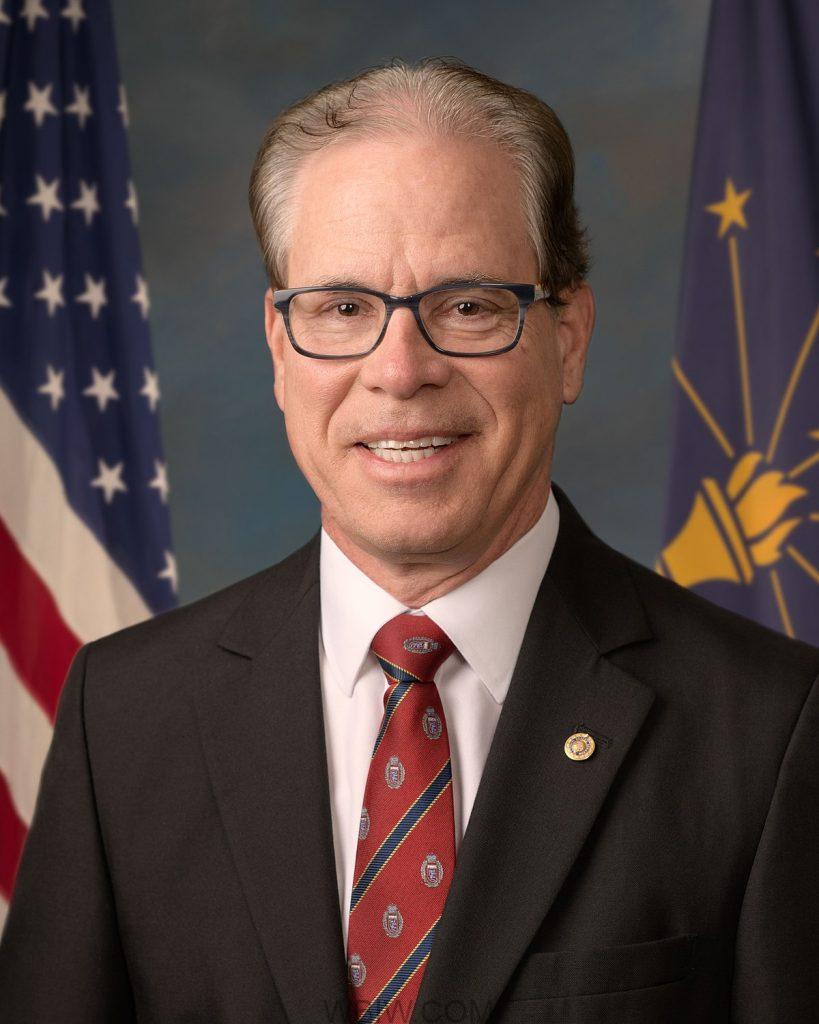

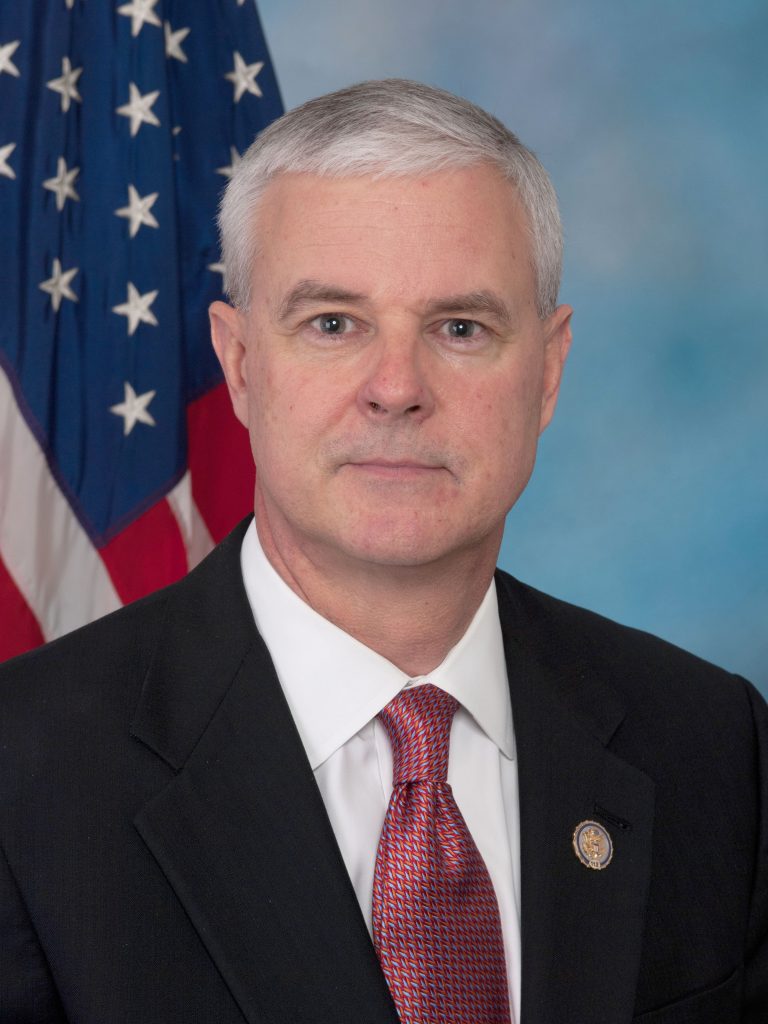

WASHINGTON—Senator Mike Braun has introduced legislation to clarify the definition of tipped employee and relieve reporting burdens that are harming the restaurant community. Representative Steve Womack (R-Ark.) introduced the companion legislation in the House.

“The Biden administration’s confusing compliance rule creates an unnecessary reporting burden for restaurants and servers that are already going through a difficult time due to inflation and rising food costs. This legislation will help streamline regulations for tipped employees so that restaurants and their workers can thrive.”— Sen. Mike Braun

“More financial uncertainty is the last thing restaurant workers want. With crushing inflation and a faltering economy, the Biden administration’s heavy-handed compliance rules only add to the burden being put on hardworking Americans. Servers don’t need the federal government skimming their pay more. Our bill brings much-needed certainty to tipped employees by protecting their income and job opportunities.” – Rep. Steve Womack

“Many servers choose restaurant careers because their skills and knowledge mean high earning potential in a job that’s flexible to their needs. For others, they’re looking for something – extra income, customer interaction, business skills – that make the opportunity ideal. The current system of tipping means that the industry can fit all their needs. We appreciate Sen. Braun and Rep. Womack’s championing of tipped income workers and their ongoing support of restaurant owners and operators.” – Sean Kennedy, Executive Vice President of Public Affairs of the National Restaurant Association

“Senator Braun has traveled the state of Indiana hearing firsthand the stories from those in the restaurant industry and how vital this income is to Hoosiers. We greatly appreciate Senator Braun for listening to our industry and taking action. The support from Representative Womack and Senator Braun will allow our industry to continue to provide opportunities to the communities we serve.” – Patrick Tamm, President & CEO of the Indiana Restaurant and Lodging Association

“We appreciate Representative Womack’s dedication to the tipped workers of Arkansas. His efforts with Senator Braun to introduce this bill shows the hardworking people with careers in the restaurant industry that their dedication is important. Their skills and knowledge are vital to the success of the Arkansas restaurant industry, and they play an integral part in the communities they support. We hope that Congress will consider these essential workers and pass this legislation.” – Katie Beck, Chief Executive Officer, Arkansas Hospitality Association.

The Tipped Employee Protection Act of 2023 would:

- Amend the FLSA definition of tipped employee to create a more explicit definition of the term by removing interpretive language (customarily and regularly), providing additional clarity and simplicity in categorizing individuals as tipped employees.

- Restrict the ability of judges or the administration to set arbitrary limits or requirements in classifying the hours or duties that a tipped employee performs.

- Preserve the tipped wage and the protection in the FLSA that tipped employees that receive at least the minimum wage between the addition of an employer-paid cash wage of $2.13 and tips—and in many cases much more. If an individual’s tips do not reach the applicable minimum wage under that formula, the employer would still be required to pay any difference.

- Retain the ability of states under the FLSA to set wages higher than the federal statutory minimum, meaning that any state could continue to independently set the wage.