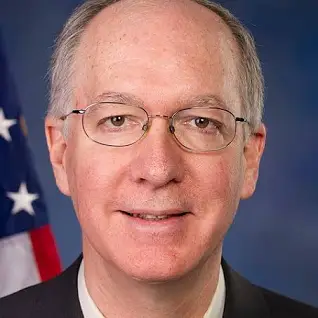

WASHINGTON, D.C. – Congresswoman Erin Houchin (R-IN), alongside Congressman Bill Foster (D-IL) and Congressman French Hill (R-AR), proudly announced the introduction of the Fostering the Use of Technology to Uphold Regulatory Effectiveness in Supervision (FUTURES) Act.

This bipartisan legislation aims to modernize technology systems within federal agencies responsible for regulating banks and credit unions, enhancing their capacity for adequate supervision and oversight. The FUTURES Act addresses the critical need for modernization in regulatory technology infrastructure to keep pace with the evolving financial landscape.

By requiring comprehensive assessments of existing technology systems and identifying areas for improvement, the bill seeks to enhance the ability of regulatory agencies to conduct thorough supervision and ensure the safety and soundness of the financial system.

“Our regulatory agencies must have up-to-date technology for financial oversight,” said Congresswoman Houchin. “Through the FUTURES Act, regulators will be able to access cutting-edge technology to protect customers and financial institutions.”

“The collapse of Silicon Valley Bank demonstrated that threats to our financial system can move much faster than previously thought,” said Congressman Foster. “Social media, 24-hour banking, and artificial intelligence will increase the speed and intensity of financial crises, and this bill is an important step to ensure our financial regulators have the tools they need to monitor and respond to these new threats.”

Key provisions of the FUTURES Act include:

- Comprehensive Technology Assessments: The bill requires federal regulatory agencies, including the Federal Reserve System, FDIC, OCC, CFPB, and NCUA, to thoroughly assess their technology systems. These assessments will identify current deficiencies and areas for improvement, including technology plans, procurement practices, workforce impacts, and information intake and analysis.

- Reporting Requirements: Within 180 days of completing the assessments, regulatory agencies must submit reports to the House Financial Services Committee and the Senate Banking Committee. These reports will include findings, evaluations, and plans for upgrading technology systems and addressing anticipated challenges.

“Technology changes rapidly, so our federal agencies and their supervisory tools must keep pace,” said Congressman Hill. “I am proud to introduce this critical piece of legislation with Congresswoman Houchin, and I thank her for her continued leadership to help our country lead in innovation.

“Congresswoman Houchin, Congressman Foster, and Congressman Hill invite their colleagues to join them in supporting the FUTURES Act and advancing efforts to modernize regulatory technology.

.png)