WASHINGTON, D.C. – The U.S. Census Bureau released new data showing an increase in the Supplemental Poverty Measure (SPM) for the second consecutive year, rising to 12.9% in 2023 from 12.4% in 2022. This rate remains above the pre-pandemic level of 11.8% in 2019, indicating ongoing economic challenges for many Americans.

Understanding Poverty Measures

The Census Bureau employs two primary measures to assess poverty:

- The official poverty measure compares pretax money income to a threshold adjusted by family size and composition.

- The Supplemental Poverty Measure (SPM), which provides a more comprehensive view by including:

- Income and payroll taxes

- Tax credits

- Noncash benefits (e.g., SNAP, housing subsidies)

- Necessary expenses (e.g., child care, medical expenses)

Impact of Government Assistance

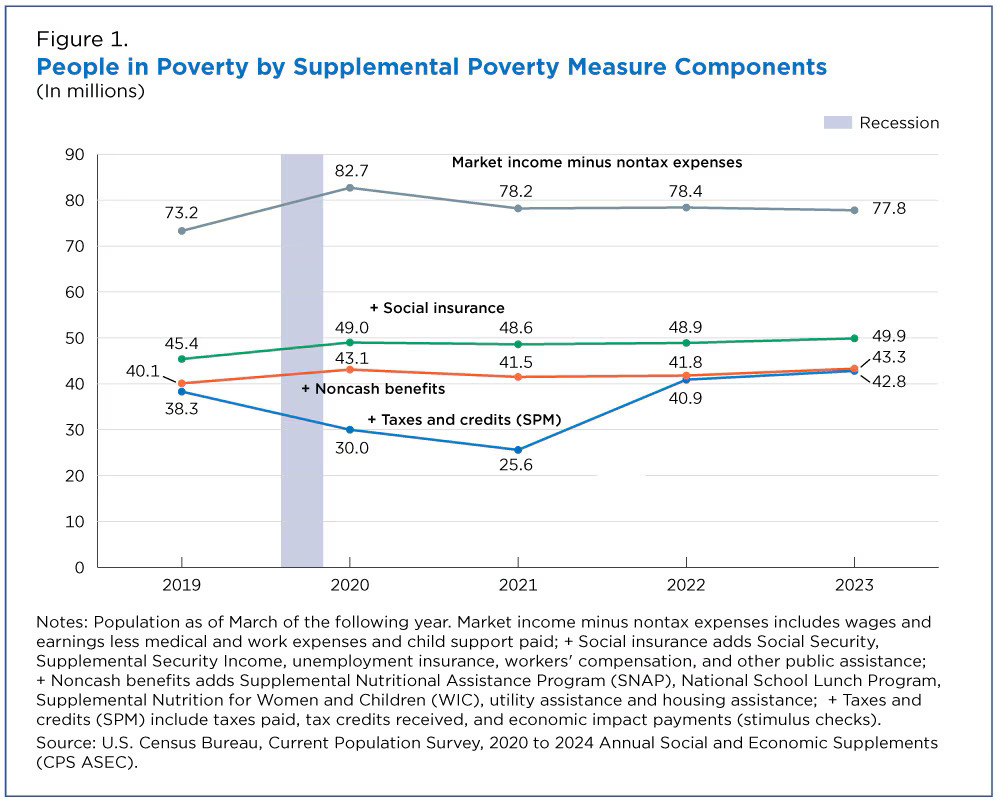

The report highlights the significant role of government assistance in alleviating poverty:

- In 2023, 77.8 million people were in poverty based solely on market income.

- Social insurance programs reduced this number by 28 million.

- Noncash benefits further decreased poverty by 6.6 million people.

- After accounting for all benefits, taxes, and credits, 42.8 million people remained in SPM poverty.

“These figures underscore the critical role of social safety net programs in supporting vulnerable populations,” said a Census Bureau spokesperson.

Changes in Tax Policy and Family Composition

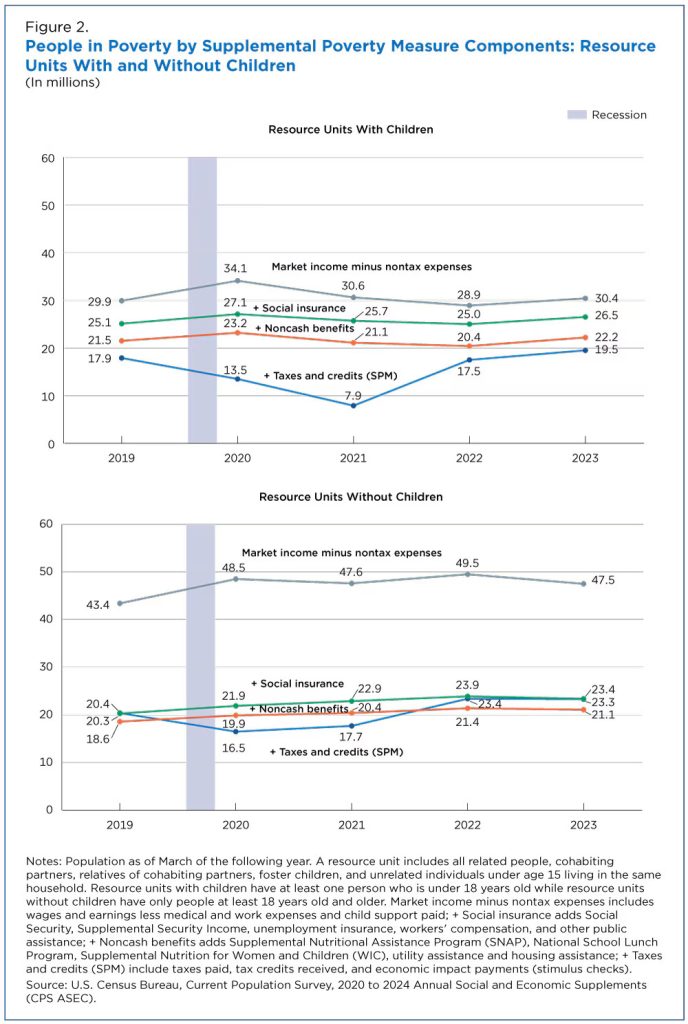

The report reveals disparate impacts of recent tax policy changes on families with and without children:

- Refundable tax credits lifted 3.4 million children above the poverty line in 2023.

- Families with children saw significant poverty reductions between 2019 and 2021, mainly due to pandemic-era policies like stimulus checks and the expanded Child Tax Credit.

- As these policies expired, poverty rates for families with children increased.

- For households without children, taxes increased poverty rates in 2022 and 2023.

“The data clearly shows how changes in tax policy can have profound and differing effects on various demographic groups,” the spokesperson added.

Looking Ahead

The Census Bureau plans to release a more detailed working paper exploring the impacts of taxes and transfers on different family compositions this fall. The annual “Poverty in the United States: 2023” report will provide further insights into how policies and programs affect the SPM rate.

As policymakers and economists analyze these findings, the data will likely inform ongoing discussions about the effectiveness of poverty reduction strategies and the need for targeted assistance to different demographic groups.