CLARK CO. – A two-year investigation concluded Monday with a male and female arrest for their involvement in corrupt business practices and failing to pay taxes while operating businesses in Clarksville.

In February 2023, Master Trooper Detective Tim Denby began an investigation based on a complaint filed against an individual residing in Clarksville who was allegedly creating Limited Liability Corporations (LLCs) for individuals not legally allowed to register their vehicles to buy, register and title vehicles through the state of Indiana.

The complainant alleged that 50-year-old Jony Zavala was charging individuals money to set up and provide vehicle registrations. It was learned through the Indiana Secretary of State’s Office that Zavala had registered 29 LLCs over the last several years for what had appeared to be fake businesses.

Detective Denby began working with investigators with the Indiana Department of Revenue in October 2023 as the investigation progressed. Investigators learned that Zavala and his wife, 40-year-old Maria Bonilla, were the organizers of at least nine LLCs within Indiana that they were principal members of. It was alleged that neither Zavala nor Bonilla had filed personal or business tax returns during their proprietorship of those businesses.

State Police detectives and investigators with the Department of Revenue served search warrants at Zavala and Bonilla’s residence in May 2024. Investigators learned that business records were not maintained for any of the nine LLCs Zavala and Bonilla owned. At the same time, Department of Revenue investigators served Zavala and Bonilla with notices to produce business records for their businesses. Zavala and Bonilla failed to provide those records to the Department of Revenue.

In June 2024, the Department of Revenue was provided with tax returns filed on behalf of Zavala and Bonilla for 2019 through 2023, which were filed after the search warrant was executed in May 2024. The tax returns were filed for only two of the nine LLCs that Zavala and Bonilla own; the business records for the other seven LLCs remained undocumented. Additionally, it was learned that Zavala and Bonilla did not provide all bank statements when preparing business records and tax returns for the two LLCs they filed for, thus failing to declare all of their income.

On Monday, Zavala and Bonilla were arrested on warrants issued through the Clark County Circuit Court for charges including Racketeering, Theft, and Tax Evasion. They were lodged in the Clark County Jail.

The Indiana State Police continues investigating complaints involving individuals making money outside the tax and regulatory system by not reporting their tax obligations. The State Police and Department of Revenue encourage all Indiana residents to register and operate their businesses lawfully.

Arrested and Charges:

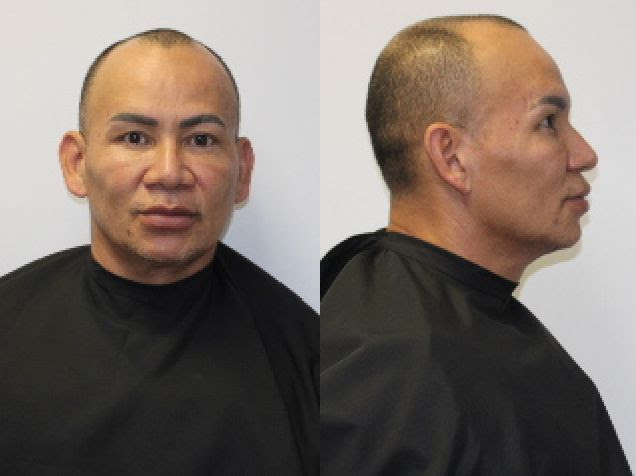

Jony O. Zavala, 50, Clarksville, Indiana

- Corrupt Business Enterprise (Racketeering), Level 5 Felony

- Theft (3 Counts), Level 6 Felony

- Tax Evasion (8 Counts), Level 6 Felony

Maria Nataren Bonilla, 40, Clarksville, Indiana

- Corrupt Business Enterprise (Racketeering), Level 5 Felony

- Theft (3 Counts), Level 6 Felony

- Tax Evasion (4 Counts), Level 6 Felony

Those facing criminal charges are considered innocent unless convicted through due legal proceedings. Accusations alone do not imply guilt; the judicial system will evaluate the presented evidence to reach a verdict.